Who Owns The Money In A 529 Plan

The best gift any parent can give a child besides unconditional love is a great education. A 529 college savings plan is a solution that is designed to help families tax-efficiently save for future college costs.

You contribute after tax money with the benefit of paying zero federal and state income taxes on the profits when it's time to use the funds to pay for college.

If your child does not end up going to college, all's not lost. You can either name a new beneficiary (different kid) or just pay the taxes on profits.

My goal is to max out my son's 529 college savings plan before he turns 18. I want him to focus on his studies and graduate with zero student debt.

The various complaints I read today about young adults with student debt are disheartening. The struggles range from saving for a house, saving for retirement, accepting a low-paying job, to starting a family.

Below are the most important pieces of information you need to know about making the best 529 plan decision. Feel free to provide feedback at the end on anything that I may have missed. I've tried to cover all the questions I had before opening up an account.

529 Plan Contribution Limit

There are two questions to answer here. The first is what is the total maximum you can contribute to your 529 plan. The second question is how much can you contribute each year to your 529 plan.

Total Maximum Contribution To A 529 Plan

To qualify as a 529 plan under federal rules, a state program must not accept contributions in excess of the anticipated cost of a beneficiary's qualified education expenses.

For example, 1 year at a mid-priced college for an in-state student can run around $24,000. A year of private school can cost around $45,000. Further, it is assumed that the average student would take no longer than five years to graduate.

Therefore, the average 529 plan limit is roughly $300,000, depending on the state. When the value of the account (including contributions and investment earnings) reaches the state's limit, no more contributions will be accepted.

For example, assume the state's limit is $300,000. If you contribute $250,000 and the account has $50,000 of earnings, you won't be able to contribute anymore. The total value of the account has reached the $300,000 limit.

These limits are per beneficiary. Thus, if both you and your father each set up an account for your child in the same state, your combined contributions and earnings can't exceed the plan limit.

Otherwise, a kid could possibly end up with multiple 529 plans worth millions. Just imagine parents, both sets of grandparents and long lost aunties and uncles making contributions to the same child.

529 Plan Annual Contribution Limit

You should only contribute a maximum of $15,000 a year. Anything more involves filing a 709 federal tax form taking a deduction against your lifetime gift-tax exclusion limit.

However, 529 plans allow you to superfund. In other words, you can gift an individual a lump sum of up to $75,000 in a single year. That's up to $150,000 for joint gifts. Superfunding does not count against your lifetime exclusion. This is provided you make an election to spread the gift evenly over five years.

In other words, once you gift $75,000, you strategically shouldn't gift more money until the sixth year. This is a valuable strategy if you wish to supercharge the 529 immediately.

Who Can Contribute To A 529 Plan?

Anyone can contribute to a 529 college savings plan account and can name anyone as a beneficiary. Parents, grandparents, aunts, uncles, stepparents, spouses and friends are all allowed to contribute on behalf of a beneficiary.

There are no income restrictions for the contributor. The maximum contribution limit applies to the beneficiary, not the individual making the contribution. Balances designated for a specific beneficiary cannot exceed the maximum allowed by the state's 529 plan.

Can You Open A 529 Plan Before Your Child Is Born?

Yes you can. But to do so, you need to initially open a plan under your own name. Then, transfer the plan to your child after birth due to the need for a social security number.

But before you open a 529 plan for your unborn child, max out your 401k and IRA first. Make sure you also plan to have kids or are able to have kids. Sometimes nature has a way of changing outcomes.

Personally, I'd wait to open a 529 college savings plan until your child is born. Just make sure to set yourself a reminder. Sleep deprivation from a newborn is a given and could cause you to forget.

While you're at it, you might as well open up a custodial Roth IRA and custodial investment account for your children too. To contribute to a custodial Roth IRA, however, required a child to have earned income.

Does A 529 Plan Affect My Financial Aid Package?

When you apply for the Free Application for Federal Student Aid (FAFSA), it'll try to ascertain your income and total assets. Logically, the higher your income and higher your assets, the less aid you will receive.

Assets in a 529 plan owned by the student or her parents count against need-based aid. Those in a plan owned by anyone else (including grandparents) don't.

But once grandparents or other relatives start taking money out of a plan to help pay those bills, the reverse is true. The withdrawals can hurt you even more than if the plan was owned by the student or parent for next year's financial aid package.

The 529 plans owned by college students or their parents count as assets. Thus, they reduce need-based aid by a maximum of 5.64 percent of the asset's value. That means if you have $50,000 in a college-savings plan for your daughter, her aid would be reduced by roughly $2,820.

However, if the 529 plans are held by grandma and grandpa, they won't appear on the FAFSA as assets. Instead, as the money is withdrawn to pay for tuition or other educational expenses, that amount must be reported on the next year's financial aid forms as untaxed income to the student. It can reduce the amount of aid by 50 percent.

Let's say that same $50,000 529 college-savings plan was owned by the grandparents. If the student withdrew $10,000 from it one year, that withdrawal could increase the amount the family is expected to pay for college (and reduce the aid) for next year by about $5,000.

The Name On A 529 College Savings Plan Matters

Therefore, the logical conclusion is to either have the 529 plan under your child's name or your name. This will minimize the reduction. Or, draw down the 529 plan under the grandparent's name in the very last year of college.

It's worth investigating how to reposition assets and income two years before your child applies for financial aid. Although it may not be worth it due to tax and performance consequences.

Can You Change The Beneficiary Of The 529 Plan?

If the existing beneficiary no longer needs the funds in your 529 account (e.g., he or she gets a full scholarship, decides not to go to college, or passes away), you may want to designate a new beneficiary instead of pay the taxes and penalty. Just fill out a change of beneficiary form and submit it to your 529 plan administrator.

If the existing beneficiary needs only some of the funds in your 529 account, you can also do a partial change of beneficiary. This involves establishing another 529 account for a new beneficiary and rolling over some funds from the old account into the new account.

The new beneficiary must be a family member of the old beneficiary in order to avoid paying taxes and penalties. According to Section 529 of the Internal Revenue Code, "family members" include children and their descendants, stepchildren, siblings, parents, stepparents, nieces, nephews, aunts, uncles, in-laws, and first cousins. States are free to impose additional restrictions, such as age and residency requirements.

Note, if you have a lot of funds, you can even use the 529 plan as a generational wealth transfer vehicle!

What If You Have Money Left Over After Your Child Finishes College?

You can save the money for graduate school or transfer the remaining funds to another child. In addition, you could keep the money growing tax free for potential grandchildren. Or pay the 10% penalty and taxes on the profits.

The exceptions relate to withdrawals made on account of the beneficiary's death, disability, receipt of a scholarship, or attendance at a Unites States military academy.

A very small handful of 529 savings plans, and nearly all of the 529 prepaid tuition plans, impose a time limit on your 529 account. If you bump up against one of these limits, you can look to move your funds to another 529 college savings plan via a qualifying rollover.

Do You Need to Get A 529 Plan From Your State?

No. Every plan allows the profits to be withdrawn federal and state tax free if the funds are used to pay for higher education (e.g. college). If the funds are not used for college, then normal taxes on earnings apply. There is no tax due on contributions as the 529 was funded with post-tax dollars.

The reason you may want to choose your state's 529 plan is due to state tax deductions on your contributions. But some states, like California, offer no state income tax deduction. Therefore, it makes sense to search around the country for the best plan possible.

You can use your 529 from whichever state to pay for college in any state.

What Is The Penalty For Withdrawing Early From A 529?

If you withdraw the funds early to pay for something other than higher education for your beneficiary, then you must pay a 10% tax plus normal federal and state income tax on the profits.

However, if there are no profits, there are no penalties and taxes to be paid. For example, if you funded $20,000 and due to a bear market you now only have $15,000, all withdrawals are penalty and tax free.

Can You Dictate A Certain Percentage Of The Contribution To Be In Cash?

Let's say you plan to jump start your child's 529 plan with $75,000, but you're worried about a stock market correction. You can't tell the administrator to only invest $30,000 and keep the $45,000 in cash until you see better opportunities.

The solution is to just fund what you are willing to invest. For example, you can send five different deposits totaling $75,000 in a two year period up to five years.

Can you Spend The 529 Plan On Grade School Tuition?

Under the latest tax plan, up to $10,000 of a 529 college savings plan can be used per student for public, private and religious elementary and secondary schools, as well as home school students. In other words, a 529 plan isn't just for college tuition anymore. This is HUGE!

If you plan to send your children to private grade school and pay the big bucks, then a 529 plan becomes even more valuable.

Who Manages The 529 Investments?

Once you understand if there are any tax deduction benefits for choosing your state (e.g. state tax deduction), then you should go about identifying which state has partnered up with the best money management firm.

Given I live in California, there are no state tax deductions. Thus, I decided to focus on which states use Fidelity, Vanguard, and TIAA-CREF because I believe they are the best firms.

I've used Fidelity for the past 16 years due to them administering my company 401k and now my Solo 401k and SEP-IRA. As a result, I'm comfortable with their service, products, interface.

Vanguard is obviously a top choice due to its low expense ratio. Finally, TIAA-CREF is another money manager I've worked with in the past. My colleague of 13 years is a Managing Director there. And, they started off as a Teachers Insurance and Annuity Association—College Retirement Equities Fund (TIAA-CREF).

Here's Fidelity's various 529 plan strategies with expense ratios.

Fidelity'sAge-Based Strategy includes portfolios that are managed according to the beneficiary's birth year. The asset allocation automatically becomes more conservative as the beneficiary nears college age.

Your beneficiary's birth year will help determine the Age-Based portfolio in which you'll invest.

This strategy offers a choice of three types of funds:

Fidelity Funds – 1.04% average expense ratio

- Seek to beat a combination of major market indices over the long term

- Portfolios invest solely in Fidelity funds.

- Managed by dedicated Fidelity portfolio managers

Multi-Firm Funds – 1.2% average expense ratio

- Seek to beat a combination of major market indices over the long term

- Portfolios invest across multiple fund companies, offering an opportunity to diversify your funds.

- Managed by dedicated Fidelity portfolio managers

Fidelity Index Funds – 0.13% expense ratio

- Seek to closely mirror the performance of a combination of major market indices over the long term

- Portfolios invest solely in Fidelity Index funds.

- Passively managed; securities currently held in the respective index determine investments.

I hate spending money on excessive management fees because most fund managers underperform their respective indices. As an example, for 2016, the performance for each category was 16.32% Index Funds, 18.33% Multi-Firm Funds, 19.34% Fidelity Funds. This means it may make sense to pay 0.91% more in fees for the Fidelity Funds due to the 3.02% outperformance.

However, over a 10-year period, it's unlikely the Fidelity Funds will outperform. Whereas you are guaranteed to pay 10% more in fees during that time period. Hence, I'm always going to select the Index fund route for a 529 plan.

Related: How To Analyze And Reduce Excessive Fees In Your 401k

The Best 529 College Savings Plans

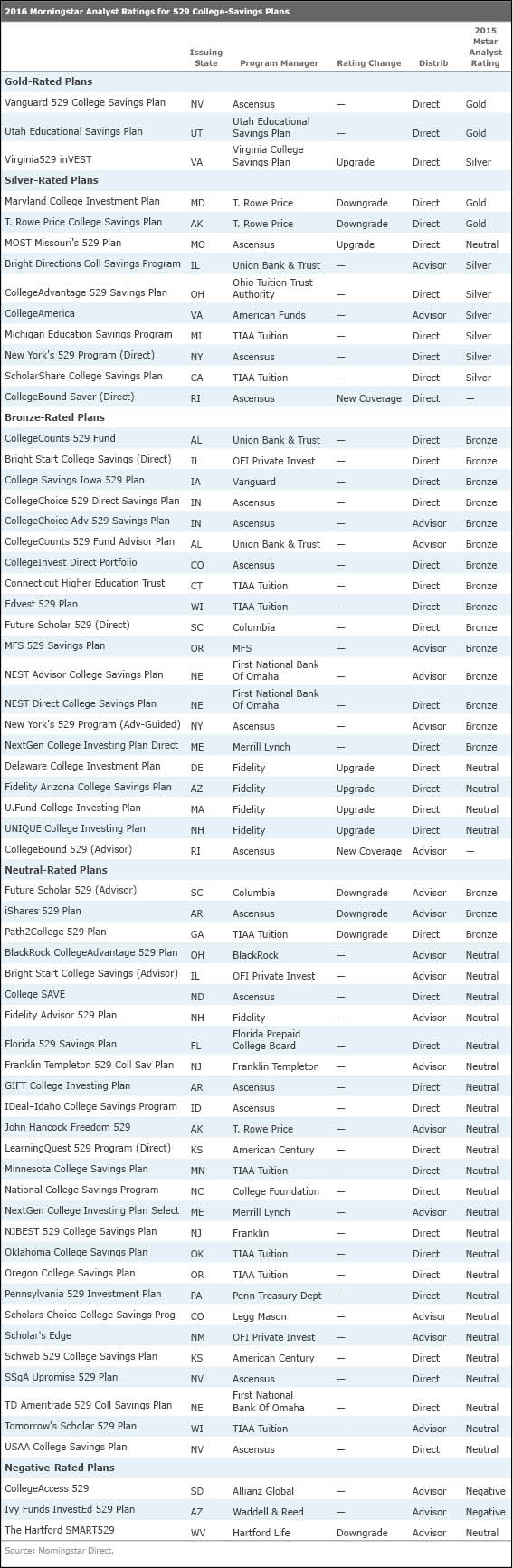

Given you're free to choose any 529 college savings plan you want, focus on the best. Let's look at a list of the best 529 plans determined by Morningstar, one of the most trusted financial rankers.

As you can see from the chart, you might as well choose a 529 plan from Nevada, Utah, Virginia, Maryland, or Arkansas. They are rated gold or were once rated gold.

In my opinion, the Nevada Vanguard plan looks like the #1 choice, followed by the California TIAA-CREF plan since I'm not familiar with T. Rowe Price or the other plans. I'm disappointed the Delaware Fidelity plan is only rated a neutral since it would be so easy for me to just go with them.

As written by Morningstar, "These plans follow industry best practices, offering some combination of the following attractive features: a strong set of underlying investments, a solid manager selection process, a well-researched asset-allocation approach, an appropriate set of investment options to meet investor needs, low fees, and strong oversight from the state and program manager. These features improve the odds that the plan will continue to represent a strong option for investors."

Profiling TIAA-CRF's 529 Plan

Here's a quick snapshot between the California TIAA-CREF 529 plan and the Nevada Vanguard 529 plan. Sorry the font size is so small. Just zoom in. Based on the comparison chart, there doesn't seem to make that big of a difference, especially if you are just buying index funds with similar expense ratios.

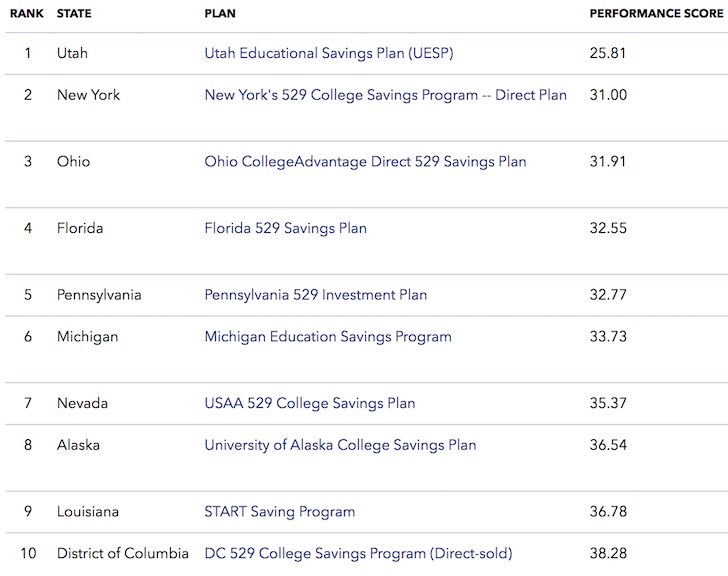

Here is another popular ranking by SavingforCollege.com. I'm looking at the 5-year and 10-year track record rankings instead of just the 1-year to iron out any anomalies.

Find A Plan You Like And Enroll

Once you've determined what you like, you can enroll directly with the plan. Simply Google the plan name or apply through your existing brokerage like Fidelity who has plans in Arizona, Deleware, Massachusetts, and New Hampshire.

They'll give you more information like I have provided in this post to make an informed decision.

Wealth Planning Recommendation

College tuition is now prohibitively expensive if your child doesn't get any grants or scholarships. Therefore, it's important to save and plan for your child's future.

Check out Personal Capital's new Planning feature, a free financial tool that allows you to run various financial scenarios to make sure your retirement and child's college savings is on track.

They use your real income and expenses to help ensure the scenarios are as realistic as possible.

Once you're done inputting your planned saving and timeline, Personal Capital with run thousands of algorithms to suggest what's the best financial path for you. You can then compare two financial scenarios (old one vs. new one) to get a clearer picture. Just link up your accounts.

There's no rewind button in life. Therefore, it's best to plan for your financial future as meticulously as possible and end up with a little too much, than too little! I've been using their free tools since 2012 to analyze my investments and I've seen my net worth skyrocket since.

Pay For Your Children's Education Through Real Estate

In addition to investing in stocks and bonds in a 529 plan, I recommend diversifying into real estate as well. Real estate is a core asset class that has proven to build long-term wealth for Americans.

Real estate is a tangible asset that provides utility and a steady stream of income. I think investing in real estate is a great way to build wealth and pay for children's education as well.

Take a look at my two favorite real estate crowdfunding platforms:

Fundrise: A way for accredited and non-accredited investors to diversify into real estate through private eFunds. Fundrise has been around since 2012 and has consistently generated steady returns, no matter what the stock market is doing.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations, higher rental yields, and potentially higher growth due to job growth and demographic trends.

I've personally invested $810,000 in real estate crowdfunding across 18 projects to take advantage of lower valuations in the heartland of America. My real estate investments account for roughly 50% of my current passive income of ~$300,000.

Who Owns The Money In A 529 Plan

Source: https://www.financialsamurai.com/529-college-savings-plan/

Posted by: handhadeventing.blogspot.com

0 Response to "Who Owns The Money In A 529 Plan"

Post a Comment